LPG Contract Price (CP)

LPG Contract Price (CP), commonly called the “Saudi CP” is the primary driver of LPG pricing in the Far East including the Philippines. It is the international price benchmark set at the beginning of each month by Saudi Arabia’s state - owned oil company Saudi Aramco.

Saudi Aramco's CPs, which set the price of propane and butane lifted from the Saudi Arabian ports of Yanbu, Ras Tanura and Ju'aymah under term supply contracts, are closely watched by the market as they tend to set a base level for LPG pricing for most markets of Suez.

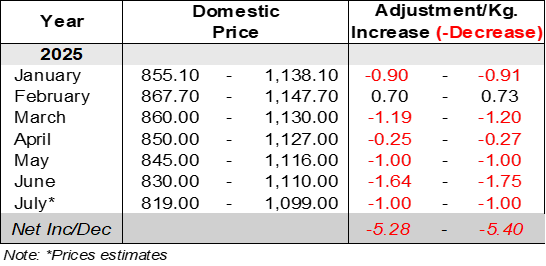

The DOE refers to the LPG/Saudi CP and monthly average forex in estimating the price adjustments of LPG in the domestic market. Following the timing of the monthly changes in CP, domestic price of LPG also changes every first day of the month and remain constant until the next adjustment in the succeeding month.

The LPG Contract Price for July is at US554.00/MT, and lower by US$25.00/MT (4%) than in June of US579.00/MT, and lower by US$15.50/MT (3%) compared to the same month last year at US$569.50/MT.

International LPG Market Development

Market News reports cited the following bearish factors behind the decrease of the month’s LPG Contract Price:

- Saudi Aramco set its July term contract prices for propane at $575/mt and butane at $545/mt, down from its June CPs, which were set at $600/mt for propane and $570/mt for butane.

- This is the fourth consecutive month that Saudi Aramco has lowered its term CP for LPG, and the first time since August 2024 that it has set its term CP for propane below the $600/mt mark.

- Saudi Aramco's July term CPs were largely in line with recommendations by some of its term lifters, which ranged over $550-$595/mt for propane and $515-$565/mt for butane during the first round of recommendations on June 23.

- Saudi Aramco also maintained the July CP spread between propane and butane at $30/mt, the widest since October 2022.

- Global LPG markets are monitoring the escalating tensions in the Middle East and the situation in the crucial Strait of Hormuz, as escalating freight rates and insurance premiums mean the market outlook is shrouded in uncertainty.

- Asian LPG recovered from a one-month low at the end of a trading week on the back of the gains in western crude benchmarks and as concerns over Middle East tensions eased following the ceasefire between Iran and Israel.

- Persian Gulf-Japan LPG freight is expected to remain on a downtrend in the week ending July 4 after falling by more than $6/mt day over day on June 27 as concerns over Middle East tensions fade following the Israel-Iran ceasefire on June 24.

- South Korea’s demand for LPG, which is used for transport and industry, fell for the fifth straight month in May as the country has been gradually reducing its tax cuts for auto fuels.

Domestic Prices

Starting 01 July 2025, the oil companies implemented a decrease of P1.00 per kilogram in household LPG or P11.00 per 11-kg cylinder. The price for the month is estimated to range from P819.00 to P1,099.00 per 11-kilogram cylinder.

The auto LPG likewise decreased by P0.50/liter resulting to prevailing price of around P40.10 per liter.

For more information, call the Department of Energy:

Pricing: 840-2187

LPG: 840-2130

Fuels: 840-5669

SMS: (0915) 4469421

Website: www.doe.gov.ph

S&P Global Commodity Insights (SPGCI)